The aggregate demand relation captures the effect of the price level on output.

It is derived from the equilibrium conditions in the goods and financial markets.

AD = (1/(1 - C1)) . (C0 + I + G - C1T)

AD = Aggregate demand

C0 = Consumption yesterday

C1 = Consumption today

I = Fixed investment

G = Pure government expenditure in nominal terms

T = Taxes

2. Animal Spirits

A spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

Reference - "The General Theory"

A possible example of this would be the era of the dot com bubble which saw investors & speculators rush to buy shares in technology companies (even companies with just a technological name). There was a confidence in the sector and market that was not justified by fundamentals.

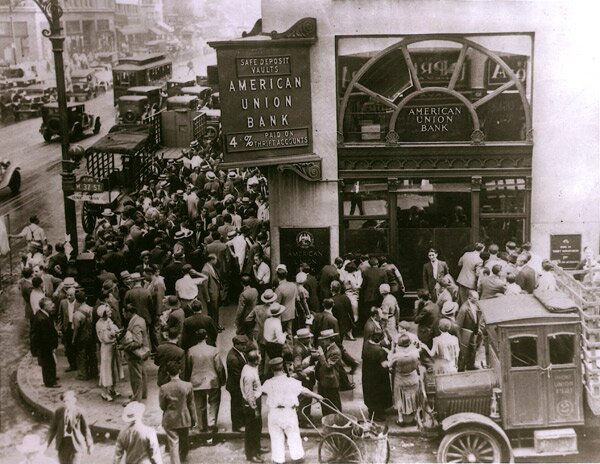

3. Bank run

A situation in which a relatively large number of bank's customers attempt to withdraw their deposits in a relatively short period of time, usually within a day or two.

Click for an example of the share price plummet of Northern Rock during a bank run in 2007.

4. Bond

A debt investment in which an investor loans money to an entity(corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate.

Reference.

An example of a bond would be a five year zero-coupon bond which might be worth €1,000,000 upon maturity. The entity would sell this type of bond to avoid having to pay coupons on a semi-annual basis and pay the full amount upon maturity so as to plough all its resources into the entities development.

The present price of the bond would be calculated as follows :

Z = M / ((1 + i)^n)

Zero-coupon bond price : Z

Value at maturity : M = 1,000,000

Yield required : i = 0.1 / 2 = 0.05

(taking i as if it was semi-annual)

Number of payments : n = 5 * 2 = 10

(taking it as though there would be semi-annual payments)

Z = €613,913

5. Capital Account

The net result of public and private international investments flowing in and out of a country.

The net results includes foreign direct investment, plus changes in holdings of stocks, bonds, loans, bank accounts and currencies.

Reference.

A prime example of foreign investment is that of the sovereign wealth funds taking stakes in financial companies in the US during the present market turbulence.

6. Debt to GDP Ratio

A measure of a country's federal debt in relation to its gross domestic product (GDP). It indicates the country's ability to pay back its debt.

Reference.

Ratio = (National Debt / GDP ) * 100

7. Effective Demand

The notion that the actual demand for aggregate output in the macroeconomy is based in the actual income or other existing economic conditions and not on income and conditions existing in equilibrium.

Reference.

8. Deflation

A decline in prices caused by a reduction in the supply of money or credit. It can also be caused by a reduction in government, personal or investment spending. Used by Classical economists to refer to a decrease in the money supply.

Reference.

Example: Japan CPI

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

3.3% 1.7% 1.3% 0.6% -0.1% 0.1% 1.8% 0.6% -0.3% -0.7% -0.7%

Reference.

9. Consumption function:

The amount of total consumption in an economy. It is made up of induced consumption and autonomous consumption. Its slope is the marginal propensity to consume and is assumed to be positive. It explains how consumption expenditures depend on the level of income.

C = co + c1*Yd

C = Consumer expenditure

co = autonomous consumption

c1 = marginal propensity to consumeYd = disposable income

Reference.

Example:

If a person’s expected income increased by €2000 and their consumption then increased by €1,600, then their mpc would be 0.8.

10. Consumer price index

Measures the percentage change in the average level of prices paid for consumer goods and services by all households and visitors to a country. It is the official measure of inflation in Ireland. It does not explain the actual price level.

Reference.

Example: Price of bread

December 2001 = base period

Dec 2001 - 100.0

Jan 2002 - 100.0

Dec 2002 - 105.4 (Source: Central Statistics Office, Ireland)

105.4

100.0 x 100 = 105.4 – 100 = 5.4%

The price of bread increased by 5.4%

11. Investment function

A model of income and interest rates. An increase in income promotes higher investment, while an increase in the interest rate may discourage investment. I = f(Y, r).

Reference.

Example: ECB interest rates:

Nov2001 Dec2002 Jun2003 Dec2005

3.25% 2.75% 2% 2.25%

Average weekly earnings of industrial workers Ireland €:

2001 2002 2003 2004 2005

512.38 538.38 564.9 588.92 609.91

From 1996-2005 Irish housing prices rose 270% due to unprecedented low interest rates and corresponding rising incomes.

Reference.

12. Fiscal Expansion

It is an increase in government spending or a decrease in taxation or a combination of both in an effort to change the direction of the economy. This will lead to a larger budget deficit or smaller budget surplus. The aggregate demand curve shifts right, real GNP increases and unemployment decreases.

Example:

13. GDP Deflator

A measure of the changes in the prices of all new, domestically produced, final goods and services in an economy. It is used to calculate real GDP. Changes in consumption patterns or the introduction of new goods and services are automatically reflected in the deflator.

Reference.

Example:

GDP Deflator – 1996=100

Reference.

14. Imports

Goods or commodities brought into one country from another country for use in trade. Inhibits the competitiveness of a country’s domestic products and services. A country will experience a trade deficit if imports exceed exports.

Example:

Ireland has experienced a trade surplus from 1996-2006. Exports have exceeded imports.

(Source: Central Statistics Office, Ireland)

15. Monetary Contraction

Contractionary monetary policy is monetary policy that seeks to reduce the size of the money supply. In most nations, monetary policy is controlled by either a central bank or finance ministry.

Reference.

16. Nominal GDP

Nominal GDP is a gross domestic product (GDP) figure that has not been adjusted for inflation.

GDP = consumption + gross investment + government spending + (exports - imports)

or,

GDP = C+I+G+(X-M)

Reference.

17. Propensity to Consume

In economics, the proportion of total income or of an increase in income that consumers tend to spend on goods and services rather than to save. The ratio of total consumption to total income is known as the average propensity to consume; an increase in consumption caused by an addition to income divided by that increase in income is known as the marginal propensity to consume.

APC = C/ (Y-T)

C = the amount spent

Y = pre-tax income

T = taxes

MPC = dC/dY

C = consumption

Y = disposable income

Reference 1.

18. Short Run

In economics, the concept of the short run refers to the decision-making time frame of a firm in which at least one factor of production is fixed. Costs which are fixed in the short-run have no impact on a firm's decisions.

Land : Fixed factor of production. A farmer can change the amount of capital or labout very easily. He can't change the amount of land owned. The length of time it would take him to buy new land is an example of the short run.

Reference 1.

Reference 2.

19. Real Exchange Rate

The real exchange rate(RER) is defined as:

RER = e(P*/P)

P = Domestic price level

P* = foreign price level

P and P* must have the same arbitrary value in some chosen base year. Hence, in the base year, RER = e.

The RER between two countries is the product of the nominal exchange rate and the ratio of prices between the two countries. If the Irish price of a good was € and the same good was priced at $3.40 in the US and e = 3.6

1.36 * 3/3.4 = 1.2

Reference 1. (.pdf)

Reference 2.

20. Trade Surplus

A positive balance of trade i.e. exports exceed imports.

The opposite is a trade deficit.

Reference.

Ireland : trade surplus 2000-2006

1 comment:

Excellent summary, lots of work put in, am impressed. S.

Post a Comment