Wednesday, May 21, 2008

Thursday, May 1, 2008

Cognitive Dissonance

Is this a trigger effect for the change in expectations? It appears to be what's happening at the moment in the Irish market (evidenced by Prime Time last night).

Four mega-dangers international financial markets face

Four dangers

The first danger we have witnessed since August 2007: The subprime mortgage crisis gave rise to a liquidity crisis in the international banking system, due to uncertainty about who holds the losses. This is leading to reduced lending to firms and households. But that is not the end of the story, because the reduced lending will lead to reduced consumption and investment. With a lag, reduced sales of goods and services will reduce stock market valuations. And, with another lag, the lower stock market prices will – in the absence of any favourable fortuitous events – intensify the banks’ liquidity crisis.

The second danger lies in the dynamics of U.S. house prices. As more and more U.S. households find themselves unable to repay their mortgages, foreclosures are on the rise, more houses are put on the market, the price of houses falls further – with further lags – this leads to more foreclosures and declines in housing wealth. This dynamic process plays itself out only gradually, as households face progressively more stringent credit conditions and house sales gradually lead to lower house prices.

The third danger results from the interaction between wealth, spending and employment. As U.S. households’ wealth – in the housing market and the stock market – falls, their consumption is beginning to fall and will continue to do so, again with a lag. This decline in consumption is leading to a decline in profits, of which more is on the way, which in turn will lead to a decline in investment. The combined decline in consumption and investment spending will eventually lead to a decline in employment, as firms begin to recognise that their labour is insufficiently utilised. The decline in employment, in turn, means a drop in labour income, which, with a lag, leads to a further drop in consumption.

And that leaves the fourth (and possibly the nastiest) of the dangers, one that concerns the latitude for monetary policy intervention. As the Fed reduces interest rates to combat the crisis, the dollar is falling. This is leading to higher import prices and oil prices in the United States, putting upward pressure on inflation. The greater this inflationary pressure – which is currently in excess of 4 percent – the more difficult it will be for the Fed to reduce interest rates in the future, without running a serious risk of inflaming inflationary expectations and starting a wage-price spiral. U.S. firms and households will gradually recognise this dilemma and the bleak prospect of little future interest rate relief will further dampen consumption and investment spending.

Wednesday, April 30, 2008

The Live Register

Note: no adjustments have been made for population increases or an increase in foreign labour.

The latest update on the Live Register is due on Friday.

The graph below is from 2006 to 2008. To try your own go here.

This graph below is from 1998 to 2008.

The 90's.

The 80's.

Friday, April 25, 2008

Nobel Thoughts - Joseph Stiglitz

The clip is 11 minutes long but gives an excellent description of the US through a discussion on savings, investment and consumption.

Saturday, April 19, 2008

HERE COMES THE ALT-A CRISIS

This short piece provides an interesting & scary comparison between the sub-prime & Alt-A levels of lending and default. The information has been obtained from the New York Fed and is pretty easy to follow.

The basics are that there is more lending in the Alt-A market for higher amounts a lot of which is for non owner-occupied housing. The lending ratio is up around the 90% mark and defaults are already at 14% which is similar to that of the sub-prime area last year.The credit rating difference between these two isn't that great. The majority of these loan applicants were based on stated income or "liar loans". And, finally, the majority of mortgage resets on the Alt-A's are set to kick in over the next two years.

There are strong comparisons that can be made between America & Ireland.

We also had 100% lending (and more).

Lax lending standards.

The "rent a room" to supplement/increase the mortgage.

Interest only loans; when people finally see the real level of repayments they have to make what will happen?

Negative equity is beginning to kick in for those who have purchased in recent times on a high loan to value rate.

In America, it's easier to file for bankruptcy, hand back the keys and walk away. It's not so easy in Ireland, but that's not to say it won't happen.

What about construction workers who can't afford their mortgages due to lack of work. What's to stop them from picking up tools, moving to Oz where there's a demand for their labour and leaving their Irish mortgage troubles behind them?

Super-Senior Debt : Greed & Avarice

First, a brief note of explanation. The concept of super-senior debt was essentially invented by creative bankers about four years ago to refer to the chunk of debt that sits at the very top of the capital structure of a collateralised debt obligation. It is the bit that gets paid off first, before other investors, if the CDO ever defaults. In theory, it makes this debt super-safe; indeed, so secure that rating agencies have been happy to give super-senior CDO debt a AAA tag, irrespective of what lay inside the CDO.

Monday, March 31, 2008

HELOC and 80/20 Mortgages in the US

First of all, we have the 80/20 mortgages. In short, this is a form of 100% financing of which 80% is with the prime lender and 20% is with the second lender at a higher interest rate. These are not subprime, they can be for the Alt-A(good credit rating)and better mortgages allowing people to lend with 0% finance. The problem arises when houses are sold at a loss or foreclosed as the prime lender has first claim on the amounts owed. Write downs for this sector have yet to take place.

Then comes the Home Equity Line of Credit (HELOC). This is where people have released equity in their houses to fund their lifestyle. It has been a big factor in the excess spending in the US. Again, when houses are sold at a loss or foreclosed, there's a big problem for these lenders. Being the third in line to 80/20, there is the potential that these lenders could see a return of zero.

Americans owe a staggering $1.1 trillion on home equity loans and in December 2007, 5.7% of home equity lines of credit were delinquent or in default. What if this number was to rise to 10% in a recession? That's another $110,000,000,000 to write down.

Some more reading.

With the 80/20 (and low interest rates), we saw the basic idea of saving & investing to purchase a house go out the window. People were encouraged to spend rather than save as they could always release equity, with the HELOC, in their rapidly appreciating home to spend more or meet debt payments when needed. This involved fictitious capital being injected into the economy at huge rates. As the various Central Banks tried to correct excessive spending by raising rates, delinquencies and foreclosures rose thus causing the banks to tighten lending procedures and incur write downs. There are further write downs to come and we won't see the end of this until the reset button is pushed and everything is marked to market.

Friday, March 28, 2008

Tuesday, March 25, 2008

Credit Squeeze Explained

Monday, March 24, 2008

Stagflation

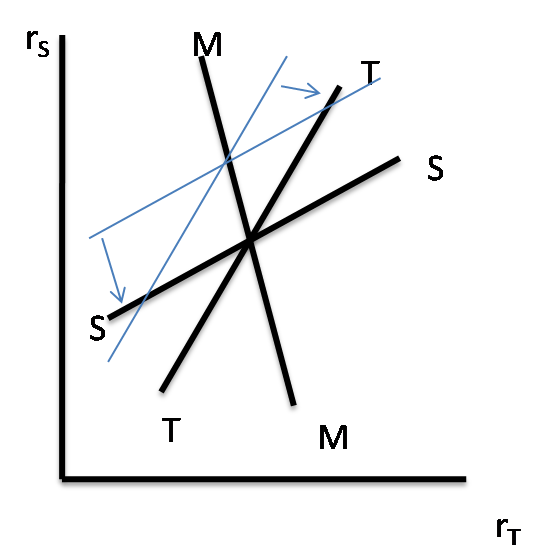

Supply shocks due to natural disasters, adverse weather, war or increases in soft & hard commodity prices can slow economic growth and/or increase inflation. The below diagram illustrates how prices may increase as supply decreases.

This has a direct affect on a households consumption & investment decisions. If inflation is high, the household may choose to consume only essential items such as utilities and food. The production sector could suffer a double blow from low consumption and an increase in raw material prices. This flow will then continue to the governments income from taxes which will be reduced. There is the potential for the stagflation to spiral deeper as the government may raise taxes, the production sector increases prices to maintain profit margin and the household consumes less & less. Additionally, if production levels are low, there is likely to be a cut back on the levels of employment which furthers the likelihood of stagflation.

The monetary policy by the central banks can also be a catalyst for stagflation. A prime example of this is the FED's decision to cut interest rates during the current credit crisis. These rate cuts have a direct affect on the exchange rate of the US dollar. The value of the US dollar has decreased against other fiat currencies, such as the euro (diagram). This makes imports more expensive which again affects household consumption and the resulting flow.

Additionally, the availability of cheap credit by way of low interest rates facilitates inflation as households are more likely to increase consumption than to increase savings due to low rates. Cheap credit leads to an increase in lending which can result in households spending beyond their means or bidding up the price in consumables, hence the inflation risk.

Monday, March 17, 2008

Black Paddy's Day?

Investment banking CDS stress. Watch out this week for the Q1 numbers from the three of Wall Street’s finest left standing. Source

How Debt Bites Back

Sunday, March 9, 2008

Friday, March 7, 2008

Monday, March 3, 2008

Blog Work 4. Question 2

The liquidity preference theory concentrates on the supply and demand for money to explain how interest rates are determined. Keynes considered the desire for individuals to hold their wealth in liquid form as the demand for money. The desire on the part of the individual was called liquidity preference, which was specifically defined as an arrangement of a person’s resources, valued on money or wage units which the person will keep in monetary form in various sets of circumstances.

According to Keynes, liquidity preference determines the actual rate of interest in given circumstances. It fixes the quantity of money, which agents will hold when the rate of interest is given.

M = L(r)

M = quantity of money

L = function of liquidity preference

r = interest rate

If the interest rate is reduced, people will increase their demand for monetary assets.

Keynes identifies three motives for people to hold their wealth in monetary form.

• Transactions motive – the need for cash for current spending

• Precautionary motive – the desire for security for unknown contingencies.

• Speculative motive – to take advantage of a profit making opportunity.

Q. 2.2

Model PC is a good illustration of Keynes’ original vision of decision-making and includes Keynes’ three divisions of liquidity preference, however it may not ultimately be a faithful representation.

Model PC states that the quantity of money held depends on the interest rate of other assets, which represents Keynes’ precautionary demand for money. The rate of interest will influence people’s desires to hold money as security for future contingencies. Model PC also relies on two decisions by households; how much to save and how to allocate these savings. According to Keynes, the marginal propensity to consume will determine how much will be saved and then households must decide in what form their money will be held; in the form of immediate liquidity or savings for a specified or indefinite period.

In the PC Model, the rate of interest equalizes the supply of and demand for bills at the end of the current period, which is the rate of interest for portfolio decisions. Similarly, Keynes maintains that the interest rate is the equalising function in the desire to hold wealth in cash form and the availability of cash.

However, in Model PC agents have perfect knowledge regarding the incomes they will receive, in fact this is how the model is built, the interest rate is also fixed such that r = ˉr with the purchase of government bills. Conversely, uncertainty is a key influence in Keynes’ model. A critical explanation for holding wealth as money is the uncertainty surrounding the future cash value of a holding of bonds and the complex rates of interest for varying maturities that will prevail at future dates. The risk in Keynes’ theory is the risk of capital losses on bond portfolios caused by an increase in interest rates, however Model PC is not concerned about possible capital gains or losses that could arise from changes in the prices of financial assets. Hence, Model PC can be seen to be a slight deviation from Keynes’ original interest rate theory.

Websites:

Reference 1.pdf

Reference 2.

Reference 3.

Government Money with Model Portfolio Choice (PC)

A central bank that can offer bills (B) at the rate of interest, r, is also added to Model PC. Using r on an asset, the agent can decide whether it is preferable to hold money or another financial asset.

Note: r is held constant over the entire period of the bond to avoid the inclusion of capital gains on the asset, thus simplifying the model.

Balance Sheet for Model PC

The household has private wealth, V, which is the sum of money, H, and bonds, Bh.

Private wealth is equal to public debt which is held by the Government, +V. This, in turn, is equal to the sum of bonds held by the household and the central bank. This allows all rows & columns to sum to zero.

Transaction Flow For The Economy

To take all transactions into account, the rows & columns each sum to zero.

With this new flow, we must incorporate the bonds issued by the Central Bank (CB) & the payments generated for households as a result of interest payments.

The inclusion of the CB sees a marked change from Model SIM with its capital & accounts components. "Current account describes inflows & outflows that form the current operation on existing assets or liabilities & salaries of CB. Capital account describes changes in the balance sheet of the CB for instance, when it purchases new bills." Additionally, any profits the CB makes are redistributed to the government giving the CB a net worth of zero.

The Equations Of Model PC

(1) National Income: Remains unchanged

(2) Disposable Income: Interest payments on government debts are added to this equation.

(3) Taxable Income: Similar to (2)

(4) Reflects the change in total wealth as a result of the difference between disposable income & consumption.

(5) Consumption function now has total wealth instead of money (SIM) as second argument. It's important the conditions are met or the economy would run out of money.

The Portfolio Decision

The PC model requires that the households decision making process is divided into two stages:

1 - A decision on the proportion to allocate to consumption & saving.

2 - A decision on the allocation of the households acquired wealth during current & previous periods.

The household wants to hold a proportion of their wealth in bonds and the remaining proportion in money. the allocation is decided by the attractiveness of the interest rate. The higher the return on bonds, the higher the proportion of wealth will be allocated.

(6) Describes the amount of money to be held taking into account the interest rate & level of disposable income to wealth.

(7) Describes the amount of bonds to be held using the same weightings as (6) but in reverse.

(8) Balancing condition: 1 = (Hh/V) - (Bh/V)

(9) Government deficit is financed by bills newly issued by the Treasury department.

(10) changes in supply of money equal changes in supply of bonds

(11)Explains how the demand to hold bonds as assets over money is determined with the use of the interest rate(12).

Quotes referenced from Godley & Lavoie, chapter 3, pages 99-107

Monday, February 25, 2008

Homework

SIM

• Households know the multiplier process and the parameters of the economy – perfect knowledge.

• Wealth is the equilibrium mechanism.

• Quick convergence rate

• Consumption function: Cd = α1*YD + α2*H-1

SIMEX

• Slow convergence rate – delayed expectations, it takes longer to approach to a steady state solution.

• Introduces imperfect knowledge/uncertainty into the model.

• Households must estimate the income they will receive and the amount of money they wish to hold.

• Households are assumed to have mistaken expectations – if realized income > expected income they will hold the difference in the form of larger cash balances.

• Role of money is the equilibrium mechanism. Money acts as a buffer and provides flexibility when expectations turn out to be incorrect.

• Consumption function: Cd = α1*YDe + α2*H-1

Despite expectations both models achieve the same stationary state.

(2)

Steady state: Y*=G/ Θ

If households’ realized income is higher than expected (W.Nse – W.Nd), households will hold the difference in larger than expected cash balances ΔHs – ΔHd. They will give up more money in the form of taxes (Td – Tse).

Expectations about income will remain unchanged before and after a shock. If actual income is higher than expected, the increase in wealth will be higher than anticipated which will make consumption grow.

In the model, if expected income is lower than realized income, the stock of wealth will grow until the consumption lost through mistaken expectations about income equals the additional consumption out of wealth. Conversely, if expected income is less than realized income, the stock of wealth will fall.

In the real world, people have mistaken expectations and there is a high level of uncertainty particularity in times of recession where people may consume less and save more. When the economy begins to recover, people may then start to consume more than they save. This demonstrates the flexibility people have with their income.

(3)

In period one there is no economic activity and none has existed. The government has injected no money into the economy and households have no income.

In period two the government spends $30, which initiates the economy and circulates within the system.

• Producers pay households 30units of cash

• Households pay 20% in taxes (6 units => YDe=24)

• Households consumption: C = α1.YDe + α2.H-1 (0.6)(24)+(0.4)(0) = 14.4

In period three the government has not injected any extra money into the economy, therefore government expenditure remains at $30.

• Households consumption: C = α1.YDe + α2.H-1 (0.6)(35.52)+(0.4)(21.12) = 30

• Expected income = realized income YDe = YD-1

In the infinite period

• GDP (Y) = G/ Θ = 30/0.2 = 150 Fiscal stance: the stationary level of income

• Taxes 150*0.2 = 30

Question 2.

It is possible to specify a version of SIM that replicates the ISLM model

The IS Curve – Saving & Investment (Goods Market)

Examining the IS curve with the SIM model in mind, we make the assumption that supply must always equal demand. Therefore, the below income equation will fit for supply and demand.

Y = C(Y-T) + I(Y, i) + G

An increase in the supply, Y, would indicate that there is and excess supply of goods. To return this equation to equilibrium, an opposite reaction would have to take place such as a fall in interest rates, i.

The fall in interest rates would be used to encourage a rise in consumption as high interest rates encourage investors to save money due to the high expense of loans or the advantages of investing in bonds.

This relationship is best displayed in the IS curve graph diagram. It can be seen in the graph that as the interest rate (i2) is increased, the output (Y2) decreases i.e. output is a decreasing function of the interest rate.

Given the above equation, and a set interest rate, we can establish that changes in consumption and taxes will shift the IS curve to the left or the right to remain in equilibrium. This is evidenced in the diagram for an increase in taxes.

Increase in Taxes: IS shift left

Decrease in Taxes: IS shift right

Increase in Consumption: IS shift right

Decrease in Consumption: IS shift left

Y: Income

C(Y-T): Consumer spending as a function of disposable income

I(Y, i): Investment as a function of real interest rate

G: Government spending

The LM Curve – Financial Markets

The below equation fits for money supply equals money demand in the SIM model.

M/P = YL (i)

An increase in Y would lead to an increase in the demand for money by households. To maintain equilibrium, it would be necessary for an increase in interest rates to bring the level of demand back to that of supply. This is best illustrated in the diagram of the LM curve where the interest rates are raised to i2 to maintain equilibrium.

Additionally, if there was an increase in the money supply, a cut of interest rates would be required. This would cause the LM curve to shift down.

Increase in Money Supply: Cut in interest rates & shift down of LM curve

Decrease in Money Supply: Increase in interest rates & shift up of LM curve.

Y: Real income

P: Price level

I: Interest rate

The IS-LM Model and some function in SIM

For the IS-LM model, we take the two graphs and combine them. The point at where they meet is the point at which both models achieve equilibrium. The basic theory behind this model is that, as a factor of either model changes, say the IS model for example, the IS model will move up or down along the axis of the LM model to maintain equilibrium.

Td = θ. W.Ns θ<1

From the previous diagram, we can see what happens as taxes are increased. Disposable income is affected which leads to and affect on output, thus the IS curve shifts to the left. As there is no tax function in the LM model, the model is not affected.

However, the change in taxes will have caused a change (decrease) in the interest

rates, as a result of the decrease in income (Y), so the IS model will move along the LM curve to equilibrium. Similar results would show for changes in money supply and consumption.

Stability

We can see from this example that a change in one factor has a direct affect on the IS model to which it is a function of and an indirect impact on the LM model. This shows how difficult it is to use just one policy to have the desired affect on the overall economy (and of course SIM).

Td :Tax demand

W.Nd :Wage rate times employment demand

Θ: proportion of change

References

Macroeconomics, Blanchard. Chapter 5

Monetary Economics, Godley & Lavoie. Chapter 3

Wikipedia

Egiwald

Roubini & Backus

MIT (.pdf)

Friday, February 22, 2008

Monday, February 18, 2008

Homework 2

1.1 Why must the vertical columns sum to zero?

The difference between the inflows of income and outflows of expenditure for each sector must match the sum of the transactions in stocks and financial assets.

For each sector the change in the amount of money held must equal the difference between the sector’s receipts and payments. For households, the change in their end of period holdings of cash must equal their wages minus taxes minus consumption. Similarly, government expenditure should equal the taxation supplied by households plus their end of period holdings of high powered money. It is assumed that producers hold no cash and therefore receipts from sales must equal their outlays on wages. This results in a zero sum rule for each column.

[Reference] Chapter 3, Monetary Economics, Godley & Lavoie

1.2 Why must the horizontal columns sum to zero?

Cs = Cd Sales of consumption services will equal purchases of consumption services.

Gs = Gd Sales of government services will equal purchases of government services.

Ts = Td Taxes supplied will equal the taxes demanded.

Ns = Nd There is a reserve of unemployed workers willing to work at the going wage.

For sales to equal purchases we use the Keynesian quantity adjustment mechanism which states that production is flexible and producers produce what is demanded. This is the most suitable approach for a demand led economy without any supply constraints and will ensure all rows sum to zero.

For row 6 ∆Hh = ∆Hs

Under Keynesian economics investment = saving. In model SIM there is no investment therefore the saving of the overall economy equals zero. ∆Hs is the government’s fiscal deficit. The two terms are equal in order for overall saving to equal zero.

Total production is not a transaction between two sectors and therefore does not sum to zero. It is used in national accounts to denote the sum of expenditure on goods and services. Y = C + G

The equations have now been satisfied so that all rows, except output, sum to zero.

[Reference] Chapter 3, Monetary Economics, Godley & Lavoie

2.1. Consumption

Within the behavioural transaction matrix, consumption represents the purchase of goods by the household. The source of funds can come from current disposable income, YD, and from savings H[t-1]. Using the Keynesian quantity adjustment mechanism, the production sector will have a consumption of Cd which is exactly equal to Cs :

Cd = Cs

Note: the level of consumption demand has a direct link to the source of government revenue from the production sector and the level of employment.

2.2. Government Expenditure

This relates to the purchase of goods and services, Gd, and is used to provide essential facilities to the nation i.e. roads & schools. The source, Gs, of income is from "revenues collected by the production sector."[1]

Gd = Gs

[1] p.63 Monetary Economics, Godley & Lavoie

2.3. Output

Output is used to describe the end result in the production sector for the given period.

This can be used to measure the productivity of the nation. The measurement can be taken in the form of "the sum of all expenditure on goods and services (C + G)or, as the sum of all payments of factor income (WB)."[1]

[1] p.61 Monetary Economics, Godley & Lavoie

2.4. Factor Income

This refers to the flow of wages for services provided by the household for the production sector.

W.Ns = wage rate times the employment supplied by the household.

W.Nd = wage rate times the employment demanded by the production sector.

W.Ns = W.Nd; factor income rises and falls as the demand/supply for labour rises or falls in the production sector.

2.5. Taxes

A government use taxes as a source of money supply, Td, to enable it to influence the direction of the economy. In order to maintain a relatively steady flow of money, a “fixed proportion of money income”[1], θ, is levied as taxes. In the behavioural transaction matrix, the supply must equal demand;

Ts = Td.

Td = θ. W.Ns θ<1

[1] p.66 Monetary Economics, Godley & Lavoie

2.6. Change in Money Stock

The change in money stock relates to the supply that the government has as a result of income and expenditure. In real terms, this is usually a surplus or deficit. A deficit may occur due to the income from taxes, Td, not meeting the required government expenditure, Gd. This would lead to the government issuing debt in the form of treasury bonds to cover the excess.

In the behavioural transaction matrix, this deficit can be explained by households saving a proportion of their income to accumulate wealth. In theory, these savings should match the deficit.

Hh = Hs

Hh = YD - Cd

Hs = Gd - Td

Key to equations

Cs :Consumption supply

Cd :Consumption demand

Gs :Government supply

Gd :Government demand

Ts :Tax supply

Td :Tax demand

W.Ns :Wage rate times employment supply

W.Nd :Wage rate times employment demand

∆Hh :Change in cash held by households

∆Hs :Change in the supply of money

H[t-1] :Cash held from the previous period

Y :Total production

YD :Disposable income

Thursday, February 14, 2008

Helicopter Ben

"In a speech in November 2002, early in his first stint with the Fed, Bernanke approvingly mentioned a Milton Friedman parable about how a "helicopter drop" of cash could push prices upward. It was simply an attempt to reassure then-skittish markets that the Fed had ways to stave off deflation, but the image of a man willing to dump bills out of helicopters stuck. In hard-money circles, Bernanke is still known as "Helicopter Ben.""

Article link.

Monday, February 11, 2008

Excercise 3

Why does this happen?

Eqn : Y* = G/θ

Y* = National Income in Nominal Terms

G = Pure Government Expenditure in Nominal Terms

θ = Personal Income Tax Rate

A : To maintain a steady state, the values of Y* and G must also change in the same direction at the same ratio.

If θ was to decrease, and both Y* and G were to remain the same, additional funds would have to be borrowed to maintain the level of G. This would result in a trade deficit.

If θ was to increase with both Y* and G remaining the same, there would be a surplus. In such an event, it is likely that the surplus would be used to enhance the incumbent governments standing by budget cuts that appeal to the masses.

Definitions

The aggregate demand relation captures the effect of the price level on output.

It is derived from the equilibrium conditions in the goods and financial markets.

AD = (1/(1 - C1)) . (C0 + I + G - C1T)

AD = Aggregate demand

C0 = Consumption yesterday

C1 = Consumption today

I = Fixed investment

G = Pure government expenditure in nominal terms

T = Taxes

2. Animal Spirits

A spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

Reference - "The General Theory"

A possible example of this would be the era of the dot com bubble which saw investors & speculators rush to buy shares in technology companies (even companies with just a technological name). There was a confidence in the sector and market that was not justified by fundamentals.

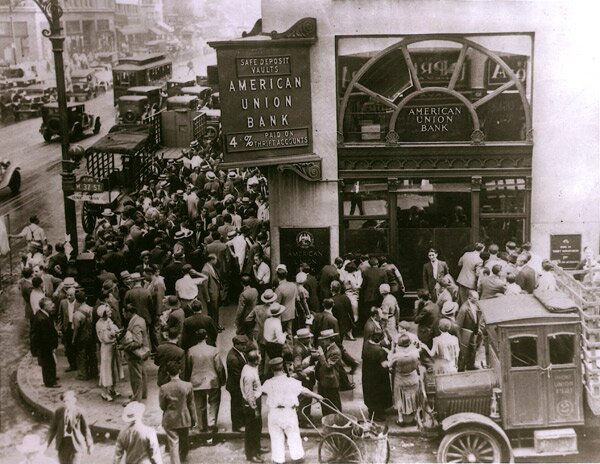

3. Bank run

A situation in which a relatively large number of bank's customers attempt to withdraw their deposits in a relatively short period of time, usually within a day or two.

Click for an example of the share price plummet of Northern Rock during a bank run in 2007.

4. Bond

A debt investment in which an investor loans money to an entity(corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate.

Reference.

An example of a bond would be a five year zero-coupon bond which might be worth €1,000,000 upon maturity. The entity would sell this type of bond to avoid having to pay coupons on a semi-annual basis and pay the full amount upon maturity so as to plough all its resources into the entities development.

The present price of the bond would be calculated as follows :

Z = M / ((1 + i)^n)

Zero-coupon bond price : Z

Value at maturity : M = 1,000,000

Yield required : i = 0.1 / 2 = 0.05

(taking i as if it was semi-annual)

Number of payments : n = 5 * 2 = 10

(taking it as though there would be semi-annual payments)

Z = €613,913

5. Capital Account

The net result of public and private international investments flowing in and out of a country.

The net results includes foreign direct investment, plus changes in holdings of stocks, bonds, loans, bank accounts and currencies.

Reference.

A prime example of foreign investment is that of the sovereign wealth funds taking stakes in financial companies in the US during the present market turbulence.

6. Debt to GDP Ratio

A measure of a country's federal debt in relation to its gross domestic product (GDP). It indicates the country's ability to pay back its debt.

Reference.

Ratio = (National Debt / GDP ) * 100

7. Effective Demand

The notion that the actual demand for aggregate output in the macroeconomy is based in the actual income or other existing economic conditions and not on income and conditions existing in equilibrium.

Reference.

8. Deflation

A decline in prices caused by a reduction in the supply of money or credit. It can also be caused by a reduction in government, personal or investment spending. Used by Classical economists to refer to a decrease in the money supply.

Reference.

Example: Japan CPI

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

3.3% 1.7% 1.3% 0.6% -0.1% 0.1% 1.8% 0.6% -0.3% -0.7% -0.7%

Reference.

9. Consumption function:

The amount of total consumption in an economy. It is made up of induced consumption and autonomous consumption. Its slope is the marginal propensity to consume and is assumed to be positive. It explains how consumption expenditures depend on the level of income.

C = co + c1*Yd

C = Consumer expenditure

co = autonomous consumption

c1 = marginal propensity to consumeYd = disposable income

Reference.

Example:

If a person’s expected income increased by €2000 and their consumption then increased by €1,600, then their mpc would be 0.8.

10. Consumer price index

Measures the percentage change in the average level of prices paid for consumer goods and services by all households and visitors to a country. It is the official measure of inflation in Ireland. It does not explain the actual price level.

Reference.

Example: Price of bread

December 2001 = base period

Dec 2001 - 100.0

Jan 2002 - 100.0

Dec 2002 - 105.4 (Source: Central Statistics Office, Ireland)

105.4

100.0 x 100 = 105.4 – 100 = 5.4%

The price of bread increased by 5.4%

11. Investment function

A model of income and interest rates. An increase in income promotes higher investment, while an increase in the interest rate may discourage investment. I = f(Y, r).

Reference.

Example: ECB interest rates:

Nov2001 Dec2002 Jun2003 Dec2005

3.25% 2.75% 2% 2.25%

Average weekly earnings of industrial workers Ireland €:

2001 2002 2003 2004 2005

512.38 538.38 564.9 588.92 609.91

From 1996-2005 Irish housing prices rose 270% due to unprecedented low interest rates and corresponding rising incomes.

Reference.

12. Fiscal Expansion

It is an increase in government spending or a decrease in taxation or a combination of both in an effort to change the direction of the economy. This will lead to a larger budget deficit or smaller budget surplus. The aggregate demand curve shifts right, real GNP increases and unemployment decreases.

Example:

13. GDP Deflator

A measure of the changes in the prices of all new, domestically produced, final goods and services in an economy. It is used to calculate real GDP. Changes in consumption patterns or the introduction of new goods and services are automatically reflected in the deflator.

Reference.

Example:

GDP Deflator – 1996=100

Reference.

14. Imports

Goods or commodities brought into one country from another country for use in trade. Inhibits the competitiveness of a country’s domestic products and services. A country will experience a trade deficit if imports exceed exports.

Example:

Ireland has experienced a trade surplus from 1996-2006. Exports have exceeded imports.

(Source: Central Statistics Office, Ireland)

15. Monetary Contraction

Contractionary monetary policy is monetary policy that seeks to reduce the size of the money supply. In most nations, monetary policy is controlled by either a central bank or finance ministry.

Reference.

16. Nominal GDP

Nominal GDP is a gross domestic product (GDP) figure that has not been adjusted for inflation.

GDP = consumption + gross investment + government spending + (exports - imports)

or,

GDP = C+I+G+(X-M)

Reference.

17. Propensity to Consume

In economics, the proportion of total income or of an increase in income that consumers tend to spend on goods and services rather than to save. The ratio of total consumption to total income is known as the average propensity to consume; an increase in consumption caused by an addition to income divided by that increase in income is known as the marginal propensity to consume.

APC = C/ (Y-T)

C = the amount spent

Y = pre-tax income

T = taxes

MPC = dC/dY

C = consumption

Y = disposable income

Reference 1.

18. Short Run

In economics, the concept of the short run refers to the decision-making time frame of a firm in which at least one factor of production is fixed. Costs which are fixed in the short-run have no impact on a firm's decisions.

Land : Fixed factor of production. A farmer can change the amount of capital or labout very easily. He can't change the amount of land owned. The length of time it would take him to buy new land is an example of the short run.

Reference 1.

Reference 2.

19. Real Exchange Rate

The real exchange rate(RER) is defined as:

RER = e(P*/P)

P = Domestic price level

P* = foreign price level

P and P* must have the same arbitrary value in some chosen base year. Hence, in the base year, RER = e.

The RER between two countries is the product of the nominal exchange rate and the ratio of prices between the two countries. If the Irish price of a good was € and the same good was priced at $3.40 in the US and e = 3.6

1.36 * 3/3.4 = 1.2

Reference 1. (.pdf)

Reference 2.

20. Trade Surplus

A positive balance of trade i.e. exports exceed imports.

The opposite is a trade deficit.

Reference.

Ireland : trade surplus 2000-2006