The next stage in the US mortgage crisis is starting to raise its head.

First of all, we have the 80/20 mortgages. In short, this is a form of 100% financing of which 80% is with the prime lender and 20% is with the second lender at a higher interest rate. These are not subprime, they can be for the Alt-A(good credit rating)and better mortgages allowing people to lend with 0% finance. The problem arises when houses are sold at a loss or foreclosed as the prime lender has first claim on the amounts owed. Write downs for this sector have yet to take place.

Then comes the Home Equity Line of Credit (HELOC). This is where people have released equity in their houses to fund their lifestyle. It has been a big factor in the excess spending in the US. Again, when houses are sold at a loss or foreclosed, there's a big problem for these lenders. Being the third in line to 80/20, there is the potential that these lenders could see a return of zero.

Americans owe a staggering $1.1 trillion on home equity loans and in December 2007, 5.7% of home equity lines of credit were delinquent or in default. What if this number was to rise to 10% in a recession? That's another $110,000,000,000 to write down.

Some more reading.

With the 80/20 (and low interest rates), we saw the basic idea of saving & investing to purchase a house go out the window. People were encouraged to spend rather than save as they could always release equity, with the HELOC, in their rapidly appreciating home to spend more or meet debt payments when needed. This involved fictitious capital being injected into the economy at huge rates. As the various Central Banks tried to correct excessive spending by raising rates, delinquencies and foreclosures rose thus causing the banks to tighten lending procedures and incur write downs. There are further write downs to come and we won't see the end of this until the reset button is pushed and everything is marked to market.

Monday, March 31, 2008

Friday, March 28, 2008

Tuesday, March 25, 2008

Credit Squeeze Explained

This is a great explanation & graphic of the credit squeeze from the FT a couple of months back.

Monday, March 24, 2008

Stagflation

Stagflation is the term used to describe the effects of high inflation, slow economic growth and increasing unemployment. A period of stagflation would have an immediate adverse impact on consumption, production and government revenue.

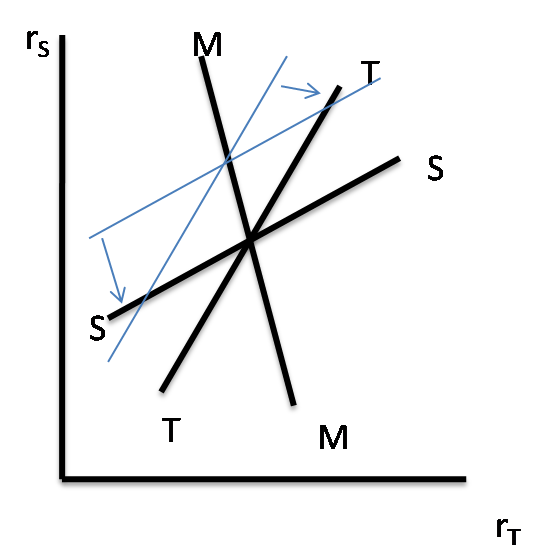

Supply shocks due to natural disasters, adverse weather, war or increases in soft & hard commodity prices can slow economic growth and/or increase inflation. The below diagram illustrates how prices may increase as supply decreases.

This has a direct affect on a households consumption & investment decisions. If inflation is high, the household may choose to consume only essential items such as utilities and food. The production sector could suffer a double blow from low consumption and an increase in raw material prices. This flow will then continue to the governments income from taxes which will be reduced. There is the potential for the stagflation to spiral deeper as the government may raise taxes, the production sector increases prices to maintain profit margin and the household consumes less & less. Additionally, if production levels are low, there is likely to be a cut back on the levels of employment which furthers the likelihood of stagflation.

The monetary policy by the central banks can also be a catalyst for stagflation. A prime example of this is the FED's decision to cut interest rates during the current credit crisis. These rate cuts have a direct affect on the exchange rate of the US dollar. The value of the US dollar has decreased against other fiat currencies, such as the euro (diagram). This makes imports more expensive which again affects household consumption and the resulting flow.

Additionally, the availability of cheap credit by way of low interest rates facilitates inflation as households are more likely to increase consumption than to increase savings due to low rates. Cheap credit leads to an increase in lending which can result in households spending beyond their means or bidding up the price in consumables, hence the inflation risk.

Supply shocks due to natural disasters, adverse weather, war or increases in soft & hard commodity prices can slow economic growth and/or increase inflation. The below diagram illustrates how prices may increase as supply decreases.

This has a direct affect on a households consumption & investment decisions. If inflation is high, the household may choose to consume only essential items such as utilities and food. The production sector could suffer a double blow from low consumption and an increase in raw material prices. This flow will then continue to the governments income from taxes which will be reduced. There is the potential for the stagflation to spiral deeper as the government may raise taxes, the production sector increases prices to maintain profit margin and the household consumes less & less. Additionally, if production levels are low, there is likely to be a cut back on the levels of employment which furthers the likelihood of stagflation.

The monetary policy by the central banks can also be a catalyst for stagflation. A prime example of this is the FED's decision to cut interest rates during the current credit crisis. These rate cuts have a direct affect on the exchange rate of the US dollar. The value of the US dollar has decreased against other fiat currencies, such as the euro (diagram). This makes imports more expensive which again affects household consumption and the resulting flow.

Additionally, the availability of cheap credit by way of low interest rates facilitates inflation as households are more likely to increase consumption than to increase savings due to low rates. Cheap credit leads to an increase in lending which can result in households spending beyond their means or bidding up the price in consumables, hence the inflation risk.

Monday, March 17, 2008

Black Paddy's Day?

Investment banking CDS stress. Watch out this week for the Q1 numbers from the three of Wall Street’s finest left standing. Source

How Debt Bites Back

Sunday, March 9, 2008

Friday, March 7, 2008

Monday, March 3, 2008

Blog Work 4. Question 2

Q 2.1

The liquidity preference theory concentrates on the supply and demand for money to explain how interest rates are determined. Keynes considered the desire for individuals to hold their wealth in liquid form as the demand for money. The desire on the part of the individual was called liquidity preference, which was specifically defined as an arrangement of a person’s resources, valued on money or wage units which the person will keep in monetary form in various sets of circumstances.

According to Keynes, liquidity preference determines the actual rate of interest in given circumstances. It fixes the quantity of money, which agents will hold when the rate of interest is given.

M = L(r)

M = quantity of money

L = function of liquidity preference

r = interest rate

If the interest rate is reduced, people will increase their demand for monetary assets.

Keynes identifies three motives for people to hold their wealth in monetary form.

• Transactions motive – the need for cash for current spending

• Precautionary motive – the desire for security for unknown contingencies.

• Speculative motive – to take advantage of a profit making opportunity.

Q. 2.2

Model PC is a good illustration of Keynes’ original vision of decision-making and includes Keynes’ three divisions of liquidity preference, however it may not ultimately be a faithful representation.

Model PC states that the quantity of money held depends on the interest rate of other assets, which represents Keynes’ precautionary demand for money. The rate of interest will influence people’s desires to hold money as security for future contingencies. Model PC also relies on two decisions by households; how much to save and how to allocate these savings. According to Keynes, the marginal propensity to consume will determine how much will be saved and then households must decide in what form their money will be held; in the form of immediate liquidity or savings for a specified or indefinite period.

In the PC Model, the rate of interest equalizes the supply of and demand for bills at the end of the current period, which is the rate of interest for portfolio decisions. Similarly, Keynes maintains that the interest rate is the equalising function in the desire to hold wealth in cash form and the availability of cash.

However, in Model PC agents have perfect knowledge regarding the incomes they will receive, in fact this is how the model is built, the interest rate is also fixed such that r = ˉr with the purchase of government bills. Conversely, uncertainty is a key influence in Keynes’ model. A critical explanation for holding wealth as money is the uncertainty surrounding the future cash value of a holding of bonds and the complex rates of interest for varying maturities that will prevail at future dates. The risk in Keynes’ theory is the risk of capital losses on bond portfolios caused by an increase in interest rates, however Model PC is not concerned about possible capital gains or losses that could arise from changes in the prices of financial assets. Hence, Model PC can be seen to be a slight deviation from Keynes’ original interest rate theory.

Websites:

Reference 1.pdf

Reference 2.

Reference 3.

The liquidity preference theory concentrates on the supply and demand for money to explain how interest rates are determined. Keynes considered the desire for individuals to hold their wealth in liquid form as the demand for money. The desire on the part of the individual was called liquidity preference, which was specifically defined as an arrangement of a person’s resources, valued on money or wage units which the person will keep in monetary form in various sets of circumstances.

According to Keynes, liquidity preference determines the actual rate of interest in given circumstances. It fixes the quantity of money, which agents will hold when the rate of interest is given.

M = L(r)

M = quantity of money

L = function of liquidity preference

r = interest rate

If the interest rate is reduced, people will increase their demand for monetary assets.

Keynes identifies three motives for people to hold their wealth in monetary form.

• Transactions motive – the need for cash for current spending

• Precautionary motive – the desire for security for unknown contingencies.

• Speculative motive – to take advantage of a profit making opportunity.

Q. 2.2

Model PC is a good illustration of Keynes’ original vision of decision-making and includes Keynes’ three divisions of liquidity preference, however it may not ultimately be a faithful representation.

Model PC states that the quantity of money held depends on the interest rate of other assets, which represents Keynes’ precautionary demand for money. The rate of interest will influence people’s desires to hold money as security for future contingencies. Model PC also relies on two decisions by households; how much to save and how to allocate these savings. According to Keynes, the marginal propensity to consume will determine how much will be saved and then households must decide in what form their money will be held; in the form of immediate liquidity or savings for a specified or indefinite period.

In the PC Model, the rate of interest equalizes the supply of and demand for bills at the end of the current period, which is the rate of interest for portfolio decisions. Similarly, Keynes maintains that the interest rate is the equalising function in the desire to hold wealth in cash form and the availability of cash.

However, in Model PC agents have perfect knowledge regarding the incomes they will receive, in fact this is how the model is built, the interest rate is also fixed such that r = ˉr with the purchase of government bills. Conversely, uncertainty is a key influence in Keynes’ model. A critical explanation for holding wealth as money is the uncertainty surrounding the future cash value of a holding of bonds and the complex rates of interest for varying maturities that will prevail at future dates. The risk in Keynes’ theory is the risk of capital losses on bond portfolios caused by an increase in interest rates, however Model PC is not concerned about possible capital gains or losses that could arise from changes in the prices of financial assets. Hence, Model PC can be seen to be a slight deviation from Keynes’ original interest rate theory.

Websites:

Reference 1.pdf

Reference 2.

Reference 3.

Government Money with Model Portfolio Choice (PC)

Model PC involves a combination of the circular flow of income approach with the stock approach. This allows us to view money as both "a device allowing transactions between agents to take place" & "a financial asset which agents hold for investment purposes".

A central bank that can offer bills (B) at the rate of interest, r, is also added to Model PC. Using r on an asset, the agent can decide whether it is preferable to hold money or another financial asset.

Note: r is held constant over the entire period of the bond to avoid the inclusion of capital gains on the asset, thus simplifying the model.

Balance Sheet for Model PC

The household has private wealth, V, which is the sum of money, H, and bonds, Bh.

Private wealth is equal to public debt which is held by the Government, +V. This, in turn, is equal to the sum of bonds held by the household and the central bank. This allows all rows & columns to sum to zero.

Transaction Flow For The Economy

To take all transactions into account, the rows & columns each sum to zero.

With this new flow, we must incorporate the bonds issued by the Central Bank (CB) & the payments generated for households as a result of interest payments.

The inclusion of the CB sees a marked change from Model SIM with its capital & accounts components. "Current account describes inflows & outflows that form the current operation on existing assets or liabilities & salaries of CB. Capital account describes changes in the balance sheet of the CB for instance, when it purchases new bills." Additionally, any profits the CB makes are redistributed to the government giving the CB a net worth of zero.

The Equations Of Model PC

(1) National Income: Remains unchanged

(2) Disposable Income: Interest payments on government debts are added to this equation.

(3) Taxable Income: Similar to (2)

(4) Reflects the change in total wealth as a result of the difference between disposable income & consumption.

(5) Consumption function now has total wealth instead of money (SIM) as second argument. It's important the conditions are met or the economy would run out of money.

The Portfolio Decision

The PC model requires that the households decision making process is divided into two stages:

1 - A decision on the proportion to allocate to consumption & saving.

2 - A decision on the allocation of the households acquired wealth during current & previous periods.

The household wants to hold a proportion of their wealth in bonds and the remaining proportion in money. the allocation is decided by the attractiveness of the interest rate. The higher the return on bonds, the higher the proportion of wealth will be allocated.

(6) Describes the amount of money to be held taking into account the interest rate & level of disposable income to wealth.

(7) Describes the amount of bonds to be held using the same weightings as (6) but in reverse.

(8) Balancing condition: 1 = (Hh/V) - (Bh/V)

(9) Government deficit is financed by bills newly issued by the Treasury department.

(10) changes in supply of money equal changes in supply of bonds

(11)Explains how the demand to hold bonds as assets over money is determined with the use of the interest rate(12).

Quotes referenced from Godley & Lavoie, chapter 3, pages 99-107

A central bank that can offer bills (B) at the rate of interest, r, is also added to Model PC. Using r on an asset, the agent can decide whether it is preferable to hold money or another financial asset.

Note: r is held constant over the entire period of the bond to avoid the inclusion of capital gains on the asset, thus simplifying the model.

Balance Sheet for Model PC

The household has private wealth, V, which is the sum of money, H, and bonds, Bh.

Private wealth is equal to public debt which is held by the Government, +V. This, in turn, is equal to the sum of bonds held by the household and the central bank. This allows all rows & columns to sum to zero.

Transaction Flow For The Economy

To take all transactions into account, the rows & columns each sum to zero.

With this new flow, we must incorporate the bonds issued by the Central Bank (CB) & the payments generated for households as a result of interest payments.

The inclusion of the CB sees a marked change from Model SIM with its capital & accounts components. "Current account describes inflows & outflows that form the current operation on existing assets or liabilities & salaries of CB. Capital account describes changes in the balance sheet of the CB for instance, when it purchases new bills." Additionally, any profits the CB makes are redistributed to the government giving the CB a net worth of zero.

The Equations Of Model PC

(1) National Income: Remains unchanged

(2) Disposable Income: Interest payments on government debts are added to this equation.

(3) Taxable Income: Similar to (2)

(4) Reflects the change in total wealth as a result of the difference between disposable income & consumption.

(5) Consumption function now has total wealth instead of money (SIM) as second argument. It's important the conditions are met or the economy would run out of money.

The Portfolio Decision

The PC model requires that the households decision making process is divided into two stages:

1 - A decision on the proportion to allocate to consumption & saving.

2 - A decision on the allocation of the households acquired wealth during current & previous periods.

The household wants to hold a proportion of their wealth in bonds and the remaining proportion in money. the allocation is decided by the attractiveness of the interest rate. The higher the return on bonds, the higher the proportion of wealth will be allocated.

(6) Describes the amount of money to be held taking into account the interest rate & level of disposable income to wealth.

(7) Describes the amount of bonds to be held using the same weightings as (6) but in reverse.

(8) Balancing condition: 1 = (Hh/V) - (Bh/V)

(9) Government deficit is financed by bills newly issued by the Treasury department.

(10) changes in supply of money equal changes in supply of bonds

(11)Explains how the demand to hold bonds as assets over money is determined with the use of the interest rate(12).

Quotes referenced from Godley & Lavoie, chapter 3, pages 99-107

Subscribe to:

Posts (Atom)